Your Guide to I Bonds: Understanding the basics and navigating your investment.

For over a decade, I bonds have been unpopular and widely unknown to common investors. When inflation was low, there was little incentive to invest in an I bond, but, that all changed last year. With inflation rapidly rising and increasing volatility in the stock and bond markets, millions of Americans rushed into purchasing inflation-protected I bonds.

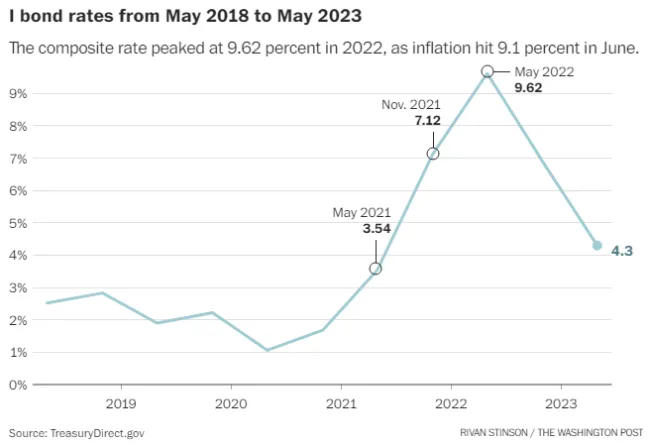

The I bond interest rate rose to 9.62% last year, the highest yield since the bond debuted in 1998. That rate has since come down to 4.3% as inflation has eased.

Like the millions of Americans who purchased I bonds, many of our clients also took advantage of the high rates. Now that the rates have come down, you might be wondering what to do now.

What is an I bond?

An I bond is short for an inflation-indexed Series I savings bond. These bonds are designed for inflation protection. There are two components to the interest rate on an I bond:

- The fixed rate

- This stays the same for the life of the bond. As inflation changes, the fixed rate remains set.

- The inflation rate

- This rate is measured by the Consumer Price Index for all Urban Consumers and is adjusted every six months.

Are I bonds still worth holding?

I bonds continue to remain a safe investment, as they are backed by the U.S. government. However, it is important to consider whether tying up your money in this type of investment is worthwhile. An I bond requires that you hold it for a full year to collect the interest earned in that first year. And, in order to earn all possible interest, you must hold the investment for five years. If you cash in before the five-year mark, you’ll lose the most recent three months of interest.

As the Federal Reserve continues to raise interest rates to tamper inflation, there are several alternative, safe, and liquid options available to people who have excess cash looking to earn a higher interest rate. This includes shorter-term U.S. Treasury Bills like 90-day U.S. Treasury Bills, which are earning 5.25% as of August 4, 2023, and are likely to continue to rise until the Fed declares a pause on rate increases. 6 Month Treasury Bills are also earning about 5.24% as of August 4, 2023. Money market funds, while earning a little less than the government T-Bills, also continue to earn about 5.17% as of August 4, 2023. All of these options are higher than the I Bond’s current 4.3% rate.

The bottom line: If you are holding an I bond, please reach out to your advisor. There may be an opportunity to forgo a bit of interest on the I bond for a higher yield in an alternative investment.

Sources: https://www.washingtonpost.com/business/2023/05/03/may-ibond-rate-43/, https://ycharts.com, https://www.schwab.com/money-market-funds

Information contained in this blog post is believed to be factual and up-to-date, but we do not guarantee its accuracy. It should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change. Charts do not represent the performance of Affiance Financial or any of its advisory clients.

Content should not be viewed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities discussed. Tax information provided is general in nature and should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation. Affiance Financial is not engaged in the practice of law or accounting.

Past performance may not be indicative of future results. All investment strategies have the potential for profit or loss. Different types of investments involve higher and lower levels of risk. There is no guarantee that a specific investment or strategy will be suitable or profitable for an investor’s portfolio. There are no assurances that an investor’s portfolio will match or exceed any particular benchmark.

The actual rate of interest for an I bond is a combination of the fixed rate and the inflation rate. The combined rate can, and does change every 6 months. Because inflation can go up or down, there can be deflation (the opposite of inflation). Deflation can bring the combined rate down below the fixed rate.

Affiance Financial is registered as an investment adviser and only conducts business in states where it is properly registered or is excluded from registration requirements. Registration as an investment adviser is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability.

Advisory services offered through Affiance Financial, a Registered Investment Adviser. Securities and advisory services offered by Registered Representatives and Investment Advisor Representatives through Private Client Services. Member FINRA, SIPC. Affiance Financial and Private Client Services are unaffiliated entities.