Message from the President: Spring 2023

What’s the biggest risk to an investment portfolio long-term? Is it inflation, interest rates, or market volatility? Unlikely. I think the biggest risk is human behavior.

We are not bullish, we are not bearish, we are process. Since its inception in 2015, our investment committee has managed investment portfolios by this principle. Now you might be thinking, what does “we are process” actually mean? At Affiance, we have established a set of processes to guide our investment management decisions. These processes are intended to improve our decision-making by avoiding behaviors that cause imprudent decisions – such as responding to short-term trends or headlines. Assessing and following a process is the foundation of our investment management. Our process-oriented approach has many layers, which are described in the linked Investment Process document.

In difficult markets, the risk usually isn't doing too little, it’s trying to do too much. One of our investment committee’s key processes is our Market Dislocation Plan. In 2022, our Market Dislocation Plan helped us during one of the most difficult years on record for combined stock and bond performance. Establishing pre-determined thresholds for market movement helped us evaluate when to buy and sell, maintain asset allocation targets, and avoid making emotional decisions. We recognize the result of emotional decisions may lead to lower portfolio returns. This is particularly the case when decisions are the result of fear or greed. At Affiance, having a process-driven approach provides the guardrails for knowing not only how, but also when to make investment management decisions.

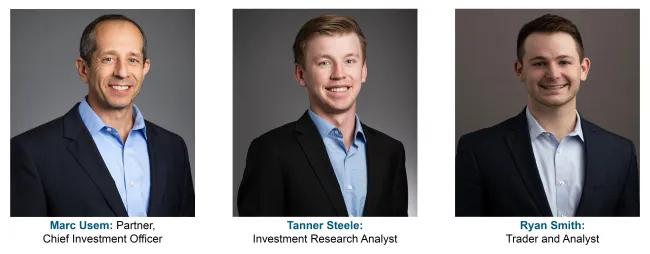

Our Investment Committee is led by Marc Usem and supported by Tanner Steele and Ryan Smith.

This team adheres to our established processes to research market conditions, make recommended changes, and ensure timely and accurate execution of portfolio changes when needed. They are supported by the other members of the Investment Committee:

What does this mean for you? We will not be derailed by headlines, sensations, or whims. What it means is that you can trust that we have a defined process for managing your money. Over time, our process is intended to provide the outcomes our clients want for their financial goals.

Thank you for the trust you place in Affiance Financial.

Respectfully,

Eric Unger, Partner, President, Chief Compliance Officer

All investment strategies have the potential for profit or loss. There are no assurances that a client’s portfolio will match or exceed any particular benchmark. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Different types of investments involve varying degrees of risk. Please remember to contact Affiance Financial if there are any changes in your personal/financial situation or investment objectives.

Affiance Financial only conducts business in states where it is properly registered or is excluded from registration requirements. Registration as an investment adviser is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability.