Fall 2021 Market Commentary

By Marc Usem

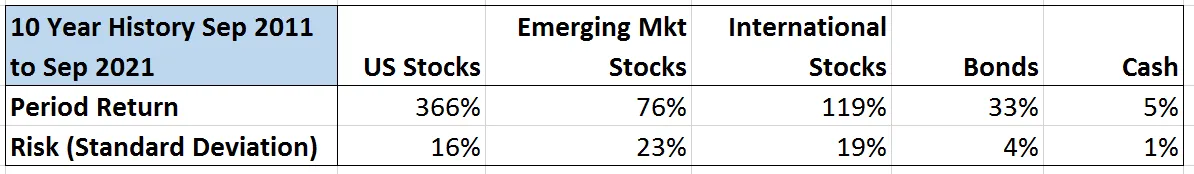

It is generally believed by investors that risk and return go hand in hand. Higher risk investments are generally associated with a greater probability of higher returns and lower risk investments with a greater probability of lower returns. That certainly has been true these last nine months when looking at U.S. stocks versus bonds. In spite of September’s market swoon, the S&P 500 is up 16.14% year to date, while U.S. bonds are down -2.7%. Returns for the U.S. stock market this year, last year, and in fact, the last 10 years have been exceptional. But past performance is no guarantee of future returns, nor is the mathematical probability of greater returns a guarantee. Results can vary significantly by asset class and over substantial time periods. Take for example, the beleaguered international and emerging market stocks. For those asset classes the relationship between risk and return has broken down for the last ten years or so, as we see in the chart below. The risk of international and emerging market stocks is greater than U.S. stocks, yet returns have paled.

During the past decade, emerging and international emerging stocks have returned only 76% and 119% respectively, compared to 366% for U.S. stocks. This appears to be a case where investors have not been rewarded for taking on more risk. So, why maintain a globally diversified portfolio if risk is not being adequately compensated in non-U.S. markets? Because we know that asset class returns can have long periods of out/underperformance, but we don’t know the exact timing. For example, during the five years between 2003 and 2008 emerging markets returned 366% while the U.S. stock market was up only 80%.

While recent U.S. stock performance has been exceptional, we believe it is prudent to lower future return expectations. While it is possible that we could have multiple years of double digit returns similar to the 1990s, it is also conceivable that there may be a period of time where investors in U.S. stock markets are not as well-rewarded for the risk taken. We remain diversified based on our expectation that other asset classes that have lagged the U.S. will help pick up the slack. Nevertheless, it is important that financial plans and return expectations are not solely based on the most recent results.

We expect that Covid, and related economic activity associated with protecting against illness will continue to be one of the primary drivers of stock market returns in the near term. As vaccines became available and the infection rate dropped last spring, we saw the market react positively. Conversely, as the infection and hospitalization rates increased this fall, it has negatively impacted the market and expectations for economic growth. Related to Covid infection rates is the continuing supply chain disruptions which were thought to be temporal, but have continued to deteriorate. Other important macroeconomic impacts include pending legislation, and related inflation pressures. Overall, government stimulus and aggressive Federal Reserve action has kept the economy on track and growing during the past year, but likely will have a more muted impact going forward.

Investor focus is clearly on the Federal Reserve, which most recently issued a hawkish statement about reducing their quantitative easing (QE), or bond purchases, of $120 Billion per month. This led to higher intermediate-term interest rates, but we expect little impact on stocks. More important will be the eventual increase in short-term interest rates, which may have some impact on stock returns, but is likely more than 12 to 18 months away. For now, we continue to see corporations buying back stock, which is positive for stock prices. Additional positive signals will be supply chains and employment correcting themselves over time. We also believe that consumer demand will remain strong due to past savings and the continued lifting of Covid restrictions. We remain optimistic that markets will reflect corporate innovation and global growth over time. Holding a diversified portfolio, staying focused on long-term goals and being patient, especially when markets get stormy, remains the best tonic for investors.

Thank you for your continued confidence in our work.

The views represented in this commentary are not meant to be construed as advice, testimonial or condemnation of any specific sector or holding. Investors cannot invest directly in an index. Unmanaged indexes do not reflect management fees and transaction costs that are associated with some investments. Past performance is no guarantee of future results. To discuss any matters in more detail, please contact your financial advisor.